By Contributing Editor: Jay Thompson

HII Technologies, Inc. (OTCQB:HIIT) is a Houston, Texas-based oilfield services provider. AES Water Solutions ("AES"), the primary operating subsidiary of HIIT, provides frac water management services ("Frac Water") to large exploration and production ("E&P") companies in Texas and Oklahoma. These E&P companies are involved in hydraulic fracturing ("Frac Drilling"). Frac Drilling allows E&P companies access to crude and liquids-rich resources that in many cases were not previously feasible prior to recent advances in Frac Drilling technologies. Frac Drilling requires a substantial amount of water per well. According to AES' website, on average, 85,000 barrels of water are needed per well. AES' services involve the provision of water transfer piping, water pumps and related equipment. A summary of the Frac Water business opportunity was discussed in an article at Rigzone.com on May 3, 2013.

No Significant Barriers to Entry

AES does not claim any technological or other barriers to entry that AES can rely on to limit competition within the Frac Water sector. The provision of water transfer piping, water pumps and related equipment, which is how AES describes their services on their website, is not a unique oilfield service offering. Most large E&P companies have personnel who already possess this experience or they have acquired companies that have a diverse and valuable suite of services for use in the Frac Water segment. Schlumberger's (NYSE:SLB) MI-Swaco subsidiary is a primary example. A description of their services, which are clearly more robust than the services provided by AES, is outlined on MI-Swaco's website.

Highly Competitive Sector

AES is not first to market in Frac Water. An article by Environmental Leader on June 18, 2013 stated that Halliburton (NYSE:HAL), Baker Hughes (NYSE:BHI) and FTS International were already using recycled water and are highly focused on water management for Frac Drilling operations in Texas and Oklahoma. These are massive companies with almost unlimited resources. We cannot see how AES could ever expect to compete with these companies. These are also the same two states that AES claims to operate in primarily. In March 2013, American Water Intelligence, a provider of industry research for the American water industry, released a list of 13 Frac Water companies to watch in 2013. This list is included in this article for the following reasons:

- To showcase both the complexity and variety of niche services being offered within the Frac Water sector.

- To clearly show that AES was omitted from this list and does not appear to have any technological advantage over others in the Frac Water sector.

- To clearly show the variety of competitors and stage of evolution of the Frac Water sector. The sector may be in its infancy but AES has not shown it is a leader and is entrenched in a highly competitive sector where many other companies have unique niche technologies that allow them to thrive.

Questionable Management

Matthew Flemming is the CEO of HIIT. It appears that other than HIIT, Mr. Flemming has no other experience in the oil & gas services sector. He is also CFO of Kairos Transmedia, Inc. according to that company's website and according to HIIT's 2013 proxy statement. He appears to be very busy. It is not clear how much of his time he devotes to HIIT. Lastly, Mr. Flemming's track record as an executive officer is as follows:

- Hemiwedge Valve Corp. (Previously part of HIIT) - Defaulted on $3M in debt, distressed asset sale in 2011

- Excalibur Industries (Previously part of HIIT) - Bankruptcy in 2005

Mr. Flemming's LinkedIn biography includes Excalibur and Hemiwedge as prior experience. These businesses were actually part of HIIT at one time. Both of them failed. Mr. Flemming is on his third try with HIIT. He should be under a lot of pressure to succeed as HIIT's CEO when he has failed in every other incarnation of HIIT he has previously led. It is entirely unclear to us why he has been given yet another chance to lead this company after serving as an executive with each of the two previous failures.

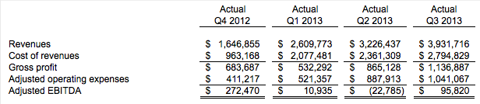

Historical Financial Results

AES was acquired by HIIT on September 27, 2012. Since the acquisition of AES, HIIT has experienced solid revenue growth and wild swings in profitability. The wild swings in profitability suggest to us that HIIT is in a state of disorganization and is not operating smoothly. Given what we know about the Frac Water sector, we believe it may also be possible that HIIT's customer base is fluctuating and the business opportunity is likely changing every day within the Frac Water sector. The following is a quarterly synopsis of HIIT's reported financial results for the last four reporting periods. Operating expenses reported in HIIT's SEC filings have been reduced by excluding any one-time items and interest, taxes, depreciation, and amortization. We are referring to the figure generated by making these adjustments as "Adjusted Operating Expenses." The net of gross profit less adjusted operating expenses is referred to herein as "Adjusted EBITDA."

(click to enlarge)

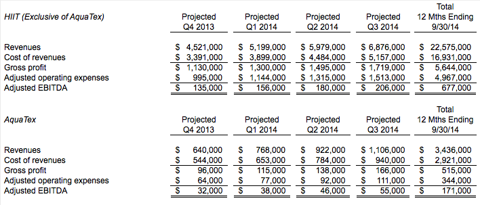

The following is a synopsis of Sky Tides' financial forecasting for the next four reporting periods. This financial forecast was developed only to estimate the potential value of the company's stock based on a forward price to earnings/adjusted EBITDA multiple. We consider this is a "best-case scenario." The assumptions utilized in this financial forecast are described in greater detail below.

(click to enlarge)

This financial forecast depicts a company that is growing its top line but struggling to grow its bottom line. We believe the top line growth metrics used in the forecast are reasonable given what data we have available to us today. We have asked HIIT's CEO Matthew Fleming for his input on this forecast. He did not respond to us. We consider a complete lack of a response from management to potentially indicate transparency issues, which should be a significant concern to any investor considering investing in HIIT.

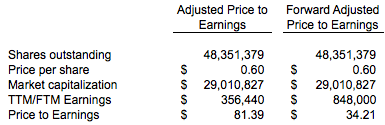

Excessive Valuation

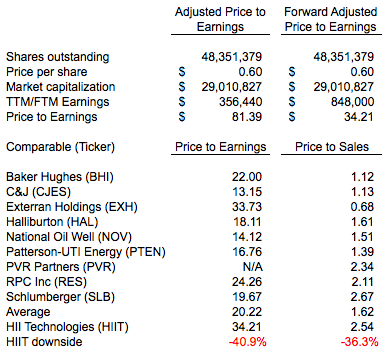

As of the date before this article was published, the price per share of HIIT's stock was $0.60. HIIT reported 48,351,379 shares outstanding in its most recent quarterly filing. This figure appears to include the 1,443,696 shares issued to Aqua in order to consummate the Aqua acquisition. HIIT did not disclose its common stock equivalents in the most recent quarterly filing. As a result, the forward price to earnings calculation included herein may be understated as the vesting or issuance of any additional shares of HIIT common stock to personnel and investors is scheduled or is possible during the next four reporting periods.

The following table calculates the adjusted price to earnings of HIIT as of the date before this article was published. Adjusted Price to Earnings is defined as the market capitalization of HIIT divided by the trailing twelve months Adjusted EBITDA of HIIT. A traditional price to earnings calculation, which would normally be based off of net income, was not possible as HIIT has a net loss for the trailing twelve months. Forward Adjusted Price to Earnings is calculated in the same manner with the exception of the denominator, which is the forecasted Adjusted EBITDA for the next four reporting periods.

The table below displays a comparison of the current valuations of a variety of both mature and high-growth oilfield services companies. This analysis, combined with our adjusted price to earnings calculation above, suggests that HIIT is significantly overvalued - if the best case scenario we outlined above for the next 12 months occurs.

Reasons for Downside Risk

- We do not believe HIIT's questionable management can deliver on the best case scenario we have outlined above, the downside risk could actually be much larger than 36%.

- Barriers to entry appear to be extremely minimal.

- HIIT has no technological advantages.

- It appears as though there is an abundance of competitors that may have technological advantages.

- Frac Water is already an extremely competitive sector in Texas and Oklahoma.

- Frac Water providers in other geographies could enter AES' markets in Texas and Oklahoma at any time and without much advance warning to AES.

- An apparent lack of long-term service agreements puts all current business at risk - customers have no need to be loyal to AES. Significant losses of business with key customers could occur at any time.

- Hot sector has inflated HIIT's stock price, valuation is excessive by any measure.

- Increasing market awareness may not be a good thing. As more investors find and examine HIIT, it is likely more questions will be asked and possibly more issues will be raised than just the issues that have been raised in this article alone.

Upside Argument

- AES' actual customer base is unknown. The customers' intent to use or not use AES' services is unclear due to the lack of long-term service agreements. Management could be downplaying their relationships with large E&P companies and could release strong news related to its customer base at any time.

- The impact of the recently announced Aqua Handling of Texas, LLC is unclear. Detailed information related to Aqua Handling is not yet readily available. This could impact HIIT's stock in either a negative or positive way in the short term.

Comments

Add new comment