By Contributing Editor: Jay Thompson

According to its website, "Green Automotive Company (OTCQB:GACR) is a state-of-the-art niche vehicle design, engineering, manufacturing, and sales company, driving innovation in the use of cutting edge zero and low emission technologies. We also provide a comprehensive after sales program maximizing the life time value of clean transport solutions."

GACR is a $100+ million company with a clear downside of at least 84%.

GACR is dramatically overvalued and has multiple near-term catalysts that should weigh heavily on the stock, resulting in massive losses for investors holding shares in a long position and massive profits for those holding short positions.

The Facts

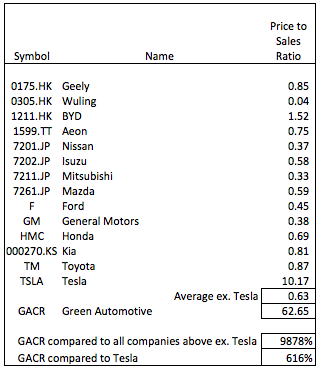

- GACR has a price to sales ratio of over 600% that of Tesla (NASDAQ:TSLA) and, on average, over 9800% of the other 13 electric car manufacturers identified in the table below. Tesla is perhaps the most exciting electric vehicle design and manufacturing company in the world at the moment.

- According to its SEC filings, GACR has never generated a profit from operations or reported net income.

- GACR claims it is a "state of the art" niche vehicle design company. Yet, GACR has spent only approximately $7,000 on research and development in the 33 months ended September 30, 2013 according to its SEC filings. It seems likely the remaining electric vehicle manufacturers outlined in the table below have spent many $ billions in just the last 12 months to ensure they maintain "state of the art" technology. Tesla alone has spent approximately $164 million in the first nine months of 2013 according to its most recent quarterly filing with the SEC. Yet somehow GACR is being valued at a price to sales ratio that far exceed Tesla's.

- GACR is led by a CEO and a CFO with no specifically identified experience or more importantly success within the electric vehicle or automotive sector in general. Management's biographies as disclosed in its annual report for 2012 and in subsequent filings with the SEC are extremely vague and not useful for an investor attempting to determine their credibility. Vague comments about executives who have done business in many countries or were involved in M&A do not suggest these individuals can lead this company as it attempts to navigate and profit within a rapidly changing innovation-based sector such as electric vehicles. According to GACR's SEC filings, it appears as though GACR's former Co-President, Mark Aubry, is the only current or former member of GACR management who appears to have had any significant success in the automotive sector. However, Mr. Aubry abruptly resigned from GACR on January 7, 2013, just 22 days after his hiring.

- Ian Hobday, GACR's current CEO, is described as a "co-founder of several innovative start-up companies and has extensive experience in developing business opportunities worldwide." It is unknown if any of the start-ups Mr. Hobday worked with were successful and how this experience specifically relates to GACR.

- Darren West, GACR's current CFO, is described as having "experience in acquisitions, mergers, and disposals." It is unknown if any of the transactions Mr. West was involved with were successful, substantial and meaningful to his work with GACR in any way.

- A recent press release by GACR seems to suggest GACR's electric vehicle is set to produce dramatic sales in the United Kingdom and that its subsidiary GoinGreen is a vibrant and massively successful business. Yet, an article on an AOL affiliated site published in February 2011 suggested that sales of GoinGreen's flagship product, the G-Wiz, which was manufactured by an Indian company and sold in the U.K. by GoinGreen. The article stated "sales of the third generation G-Wiz have tanked and with the electric segment heating up, the less-than-spectacular G-Wiz, with its top speed of 50 miles per hour and range of 48 miles, no longer holds the distinction as one of the only battery-powered autos offered in the UK."

- GoinGreen appears to be a failing acquisition. The purchase price of GoinGreen was $565,290. None of GACR's SEC filings during 2013, subsequent to the acquisition, make mention of any G-Wiz sales by GoinGreen - or for that matter any sales of any vehicles in the United Kingdom at all. It appears as though any sales of the G-Wiz in 2013 are insignificant, if there are any, and surely, considering no disclosures of sales have been made in the SEC filings, the sales are not approaching a run-rate close to the $1 million in annual sales GoinGreen was said to have previously reached as GACR referenced in its press release announcing the acquisition.

- Likewise, neither revenues or equity in the income of its investee, Powabyke, is reflected in GACR's SEC filings since GACR acquired Powabyke on May 16, 2013. The acquisition was announced by press release. Management has said that the purchase price of $335,895 was not impaired as of September 30, 2013. However, given that no results of operations from Powabyke for the months between May and September 2013 appear to be included in the recent September 30, 2013 quarterly filing, it appears Powabyke has no operations and may also be a failing acquisition. GACR's two acquisitions in 2013 could result in an impairment loss in the near future of at least $901,185, which is the combined purchase price of the two U.K. entities and approximately 39% of GACR's total assets as of September 30, 2013.

- Another recent press release suggested that Ironridge Global ("Ironridge") invested $545,409 in GACR. However, this "investment" does not appear to be a long term investment as Ironridge has obtained a securities exemption under Section 3(a)10 and will be able to sell its holdings in GACR immediately, at any time, in order to recoup its investment. The press release is misleading at the very least and does not address the immediate and additional potential dilution management agreed to when it issued shares to Ironridge. According to an SEC filing on December 5, 2013, Ironridge received 7,700,000 shares of GACR. Although Ironridge may be required to return a portion of these shares under certain circumstances, these shares are nonetheless held by Ironridge at this time at an effective cost basis of approximately $0.07 per share ($545,409 / 7,700,000 = $0.07). This equates to a 77% discount to the current market price of GACR shares. Ironridge can therefore sell shares of GACR at will and without consideration of the impact the sales have on the market while the stock price is well above $0.07 per share.

- GACR's subsidiary Newport Coachworks, Inc. ("Newport") has one customer. That customer purchased buses from Newport totaling $828,883 in the nine months ended September 30, 2013. GACR does not disclose the unit sales (number of buses) or the average profit, if any, that was earned on each bus sale. GACR does not disclose in its SEC filings why these buses are special and how they compare to the alternatives. The Newport website does little to define why the buses are innovative or likely to be chosen by customers over other alternatives.

- Furthermore, Newport's one "customer" is not really even a customer. Merriam-Webster defines a customer as "one that purchases a commodity or service." Don Brown Bus Sales, Inc. ("Don Brown") is just a distributor for Newport - according to the contract. It does not appear as though Don Brown is required to actually purchase buses from Newport. The contract with Don Brown is extremely vague but it appears that Don Brown just markets the buses for Newport. Perhaps there is another arrangement not included within the contract to allow Don Brown to receive a commission on any bus sales. The actual relationship between GACR and Don Brown is very unclear. According to the contract between Newport and Don Brown, Newport is to deliver a certain number of buses per month to Don Brown and Don Brown is expected to sell the buses. The cheapest Newport bus for sale on Don Brown's website is $109,000. Since Newport's sales for 2013 so far have only been $828,883, it seems as though Newport may have only delivered approximately 10 buses to Don Brown in 2013, assuming Newport has a 20% profit margin, which is just an arbitrary estimate we are assuming. The actual profit margin may be lower or higher than this but GACR does not disclose this percentage in its SEC filings. An investor is left to guessing. However, according to the contract filed with the SEC a total of 70 buses should have been delivered to Don Brown between January and September 2013. Don Brown was also required to maintain a minimum inventory of 12 buses at all times according to the contract but the website currently only shows 8 buses for sale. It appears Newport has breached its contract with Don Brown and has been unable to deliver buses or Don Brown has breached the contract and has been unable to sell the buses. Yet, in a variety of press releases during 2013, GACR has promoted the Don Brown contract and told investors a total of 432 have been "ordered" by Don Brown. These buses were contracted to be delivered between December 1, 2012 to December 1, 2014 according to the contract. That is a 24 month window. In the first 10 months of the contract, it appears possible that only 10 and not more than 12 buses may have been delivered. It seems highly unlikely that another 420+ buses can be delivered in the final 14 months of the contract when only about 10 appear to have been delivered in the first 10 months. Don Brown has the right to cancel the contract with Newport with notice. Management appears to be following a tradition of over-hyping its stock to say the least. Investors should demand further details on the relationship with Don Brown. It is also worth noting that it appears GACR has not disclosed if Don Brown, Newport's only "customer," is a fully independent party to GACR.

- Newport appears to be the largest revenue producing business segment for GACR by far yet it does not appear the purported order for 432 buses is for buses that are electrically-powered. These buses are referenced in an article where GACR's CEO is quoted as diesel or compressed natural gas-powered buses. Also, none of the buses on Don Brown's site are electric-powered. Yet, Newport refers to itself as "America's EV Specialist."

- GACR's subsidiary Liberty Electric Cars Limited ("Liberty") also has just one customer. That customer accounted for $126,086 in GACR sales during the nine months ended September 30, 2013. GACR does not disclose what services provided or products were sold to this customer. Very little detail is provided by GACR.

- The revenues generated by Newport and Liberty for the nine months ended September 30, 2013 totaled $954,969. This represents 57.3% of the total revenues reported by GACR for the nine months ended September 30, 2013. No significant additional information is known about the remaining portion of the revenues, which represent approximately 42.7% of GACR's revenues for the period. No information is available about the potential recurrence of this revenue or even the profitability, if any, associated with those particular revenues.

Market Capitalization

GACR has a fantasy-like market capitalization of approximately $122 million. This valuation includes and assumes the 7,700,000 shares issued to Ironridge on or about December 4, 2013 were the only shares of GACR that were issued since the most recent quarterly report was filed with the SEC. A quick consideration of the various possible valuation methods an investor could consider when attempting to value GACR is below.

- Price to earnings. This methodology will result in negative value as GACR has no earnings.

- Price to book. This methodology will result in negative value as GACR's liabilities of approximately $53 million exceed its assets of approximately $2 million by 2,650%.

- Discounted cash flow. No conversations with management have occurred in connection with this article and there is limited information available publicly about GACR's future plans. As a result, the development of an accurate discounted cash flow is not possible. However, given the historical results of GACR, it is very difficult to see the current valuation being justified by management.

- Price to sales. This methodology can be utilized. Financial metrics and public market valuations of relevant comparable automotive companies are readily available.

The following table details the relevant financial data associated with fourteen companies operating in GACR's sector. This is assumed to be a reasonable sample size for the calculations and comparisons made in the table below. All of these companies have specific known-exposure to the electric vehicle market.

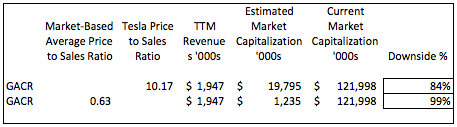

This table outlines the fact that when considering the price to sales ratio, GACR is currently over-valued as compared Tesla by 616% and as compared to GACR's peers, excluding Tesla, by 9,878%.

If GACR management were able to convince an investor that GACR's shares are worthy of being valued at the same multiple as Tesla, then GACR's estimated market capitalization would be approximately $20 million. This value is approximately 84% less than GACR's current market capitalization as outlined in the table above. GACR is massively overvalued as compared to Tesla.

If the average price to sales ratio of the sector, as determined in the table above that excludes Tesla, is applied to GACR, then GACR's estimated market capitalization would be approximately $1 million. This value is approximately 99% less than the current market capitalization as outlined in the table below. GACR is massively overvalued when compared to these selected sector metrics.

Short-Term Catalysts

The following are the various short-term catalysts that should force GACR's stock downward in the next several months.

- On December 5, 2013, Ironridge filed a Form SC 13G with the SEC stating its had received an issuance of 7,700,000 GACR shares. These shares were issued in connection with an agreement between GACR and Ironridge to settle outstanding payables under Section 3(a)10 of the Securities and Exchange Act of 1933. The issuance represented an immediate substantial dilution to GACR shareholders. Additional shares are issuable to the extent Ironridge requires the shares as Ironridge sells GACR shares into the market in an attempt to profit on its purchase of $545,409 in accounts payable it purchased from GACR vendors. Each issuance of shares to Ironridge is at a 20% discount to market. When considering the time value of money and the possibility that GACR has other shareholders with very low cost basis in their shares, it is entirely in Ironridge's interest to liquidate its position in GACR as soon as possible to recover its investment and book its profits. The trading volume of GACR should increase as Ironridge sells its shares of GACR. Given that Ironridge has a 20% immediate profit in its holdings of GACR, an investor should expect Ironridge will continue to sell shares even when GACR's stock is already declining. A total of 3,526,300 shares of GACR have traded in a recent sample six month period (May 19, 2013 through November 18, 2013). The shares held by Ironridge represent over 200% of the number of shares traded in the market in the recent sample six-month period.

- On November 12, 2013, GACR filed an amended registration statement to register a total of 25,000,000 shares of GACR's common stock for sale into the marketplace by Kodiak Capital Group LLC ("Kodiak"). Kodiak is providing funding to GACR through an equity line. This represents dilution to stockholders of approximately 6.3%. An equity line allows a third party to sell shares into the marketplace on behalf of GACR, returning the majority of the proceeds from the sales to GACR. The fund takes a fee for executing the sale of stock on behalf of GACR. As a result of the inherent structure of the equity line, where the fund selling shares has a protected downside risk, the fund has more incentive to sell shares at any price rather than it does to sell shares at a particular price. The shares being registered represent over 700% of the number of shares traded in the market in a recent sample six-month period, as defined above. The pressure on GACR could mount almost immediately as soon as the Form S-1 registration statement has been approved by the SEC, which could be any day now. Kodiak may want to exit its position in GACR immediately since Ironridge and the owners of the Series A Shares are also likely to be selling GACR shares into the market.

-

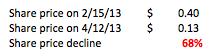

A total of 908,475 shares of GACR's Series A Preferred Stock (the "Series A Shares") were outstanding as of September 30, 2013. We estimate a total of at least 361,792,929 were potentially issuable to the holder of the Series A Shares as of September 30, 2013, without considering any limitations. The number of shares issuable to the holder increases with each issuance of GACR common shares. The holder of the Series A Shares has the ability to convert and sell into the market as they wish. The ongoing sale of common stock issued to the holder of the Series A Stock will pressure the stock price downward. Below is a calculation of the per share price decline in GACR common stock for the period from February 15, 2013, through April 12, 2013, the time period when approximately 20,437,331 shares of GACR traded subsequent to the issuance of 20,437,331 common shares to the holder of the Series A Shares. This is an example of the downward trading effect an issuance of approximately 20 million shares can have on GACR's stock. It is important to note that 7.7 million shares of GACR shares were just issued to Ironridge. Another 25,000,000 shares are potentially issuable to Kodiak upon the S-1 being approved by the SEC. Lastly, the Series A Shares held by the primary shareholder were last issued in July 2013. A total of approximately 16 million shares were issued. It seems possible that the holder of those Series A Shares may have sold all of those shares by now and could request another issuance of GACR stock soon. This is very bad news for any current GACR shareholder.

- The ongoing issuance of Series A Shares also represents a massive potential 90%+ dilution risk to any shareholder holding GACR shares. During 2013, thus far, each individual issuance of Series A Shares in 2013 resulted in immediate dilution to shareholders representing a loss of value in their shares of approximately 4% and 6%. These issuances will continue. The holder of the Series A Shares is doing very well selling shares of GACR. The holder has plenty of incentive to continue selling shares of GACR whenever possible.

- GACR may soon have to admit to shareholders that it will not be possible to meet its target of delivering 432 buses to Don Brown between December 1, 2012 and December 1, 2014. This contract has been aggressively promoted by GACR. It is possible that many GACR shareholders hold shares of GACR simply because of this single contract. An admission such as this may result in many shareholders selling their GACR shares. GACR may not have a choice and may have to provide investors an update regarding the likelihood of meeting the contract demands.

- GACR had two customers that made up 57.3% of sales for the nine months ended September 30, 2013. It is entirely unclear whether the sales of buses or provision of electric vehicle services represents recurring revenue that GACR can count on moving forward. Given the nature of the business GACR appears to be in, it seems reasonable that those sales are not recurring and GACR has a risk of losing either one of these customers and perhaps both, which would represent a loss of over half of GACR's revenues. With such a small customer base, if Don Brown is actually a customer, the loss of a customer is possible at any time. The loss could very well be significant and cause GACR to curtail operations and even potentially shut down entirely. This is not the hallmark of a $100+ million company.

Comments

Add new comment